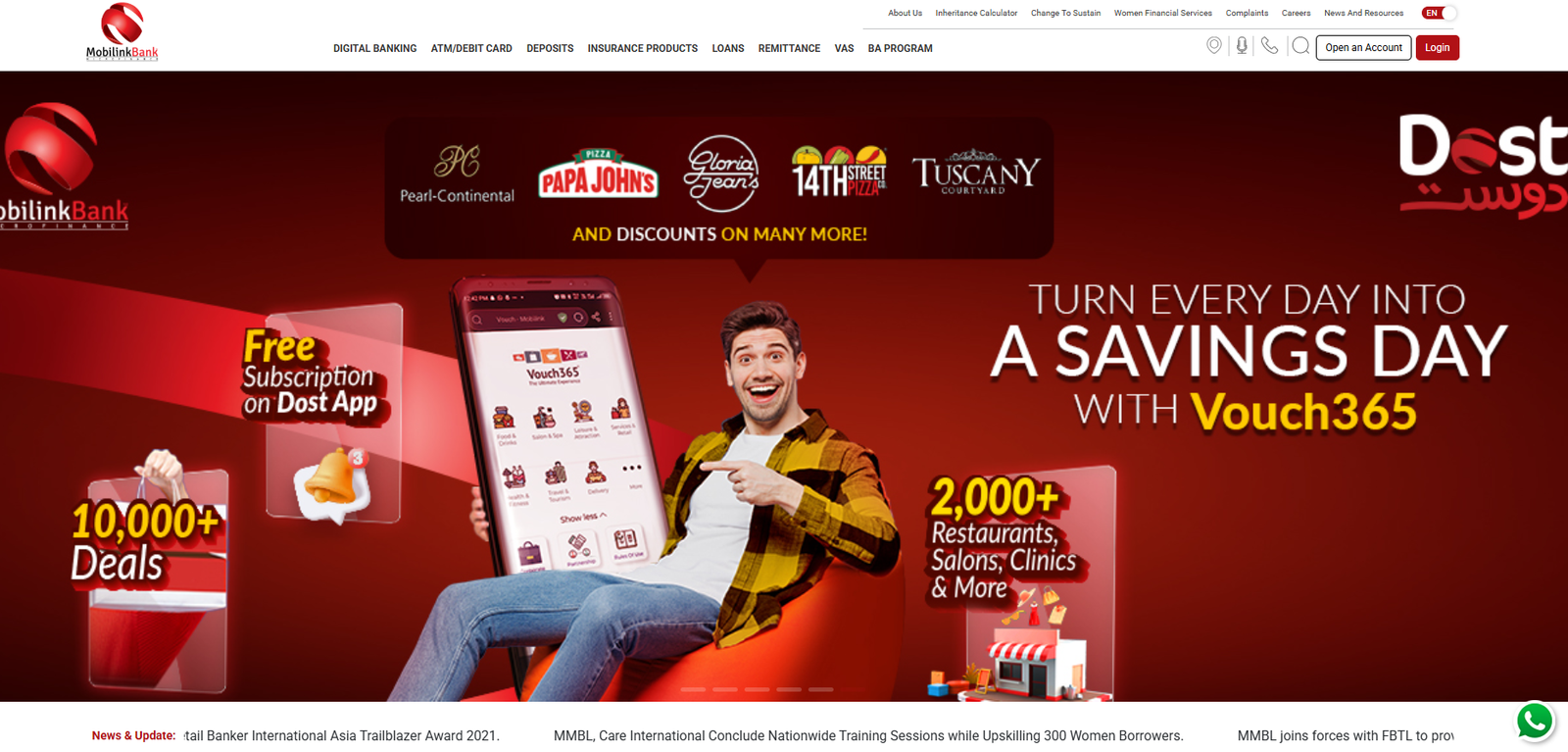

Project Overview:

Mobilink Microfinance Bank Limited (MMBL) is Pakistan’s leading digital microfinance institution, committed to promoting financial inclusion through innovative digital solutions. Established in 2012 and headquartered in Islamabad, MMBL offers a comprehensive suite of financial services, including digital banking, loans, deposits, insurance products, and remittances. The bank operates on a robust technological infrastructure, utilizing platforms such as Microsoft Azure for application hosting, Temenos T24 for core banking solutions, and Drupal for its website content management system. With over 42 million registered users and 16 million active digital wallets, MMBL is at the forefront of transforming Pakistan’s banking landscape.

Development Highlights:

- Drupal CMS Integration: Implemented Drupal to manage dynamic content efficiently, ensuring scalability and flexibility.

Responsive Design: Developed a mobile-friendly interface to provide seamless access across various devices.

Digital Banking Solutions: Integrated services like the DOST App and Internet Banking to enhance user convenience.

Comprehensive Product Offerings: Showcased a wide range of financial products, including loans, deposits, and insurance, tailored to diverse customer needs.

Performance Optimization: Utilized Microsoft Azure Cloud Services to ensure reliable and scalable application hosting.

Core Banking System: Employed Temenos T24 for efficient and secure core banking operations.

Security Measures: Implemented robust security protocols to protect user data and transactions.

SEO Optimization: Enhanced site structure and content to improve search engine visibility and user engagement.

Outcome: The Mobilink Microfinance Bank website serves as a comprehensive digital platform, effectively bridging the gap between traditional banking and modern financial solutions. Its user-centric design and extensive service offerings have significantly contributed to financial inclusion in Pakistan, providing accessible banking services to a diverse clientele. The integration of advanced technologies ensures a secure, efficient, and engaging user experience, solidifying MMBL’s position as a leader in the digital microfinance sector.